Buy Now, Pay Later: What Is It and How to Use It

Buy Now, Pay Later: What Is It and What Does It Mean

Emily Ros • August 27, 2025

What is a Buy Now, Pay Later (BNPL) loan?

Buy Now, Pay Later (BNPL) is a type of installment loan that allows you to make an online purchase or through a mobile app for in-store purchases. Depending on your provider you can split the payment into 2 or 4 interest-free payments. However, when you increase to 6 or 12 monthly payments, an interest rate may apply. Unlike a credit card, every time you utilize a BNPL, your creditworthiness may be evaluated through a soft credit check.

What is a soft credit check?

A soft credit check, or a soft inquiry is when you authorize someone to check your credit report and is not visible to other lenders. The majority of BNPL providers perform a soft credit check, which does not affect your credit, but the details depend on the specific company and the repayment plan that you choose. You can learn more about the details from our providers below:

Why use buy now, pay later (BNPL)?

Buy Now, Pay Later offers flexible solutions if you want to make your purchases more manageable by paying them off over time.

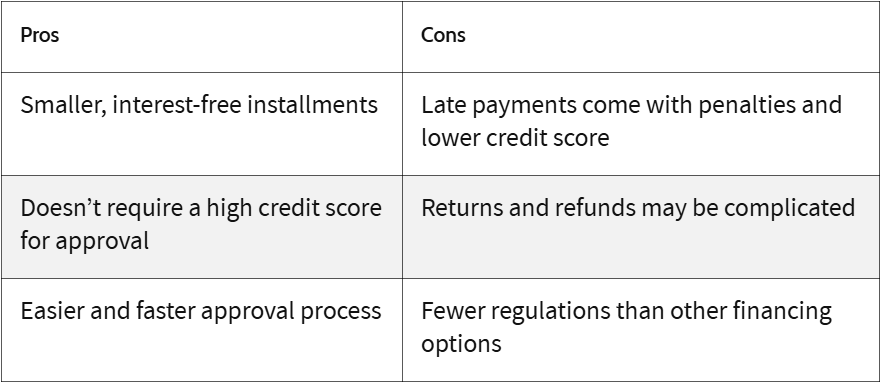

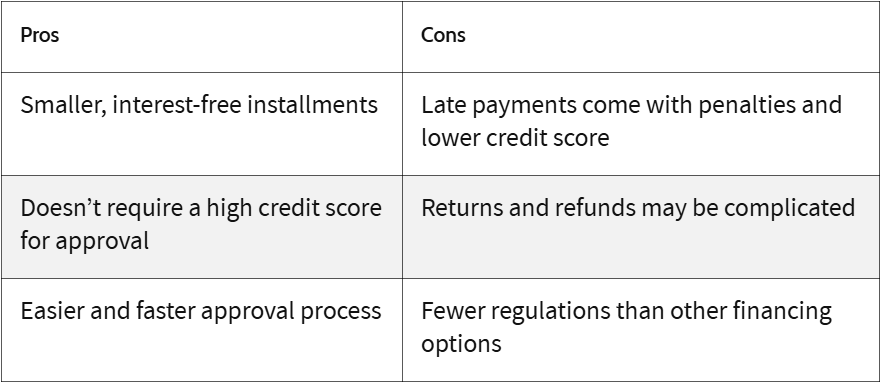

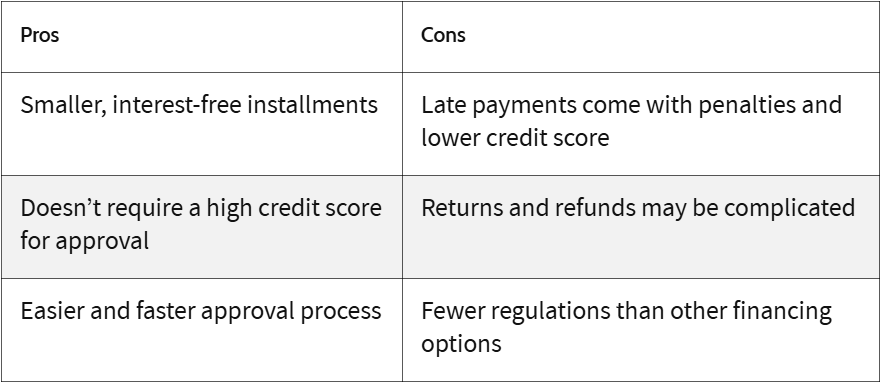

What are some of the risks?

BNPLs are a convenient option to make expensive purchases seem more affordable, but there are still some downsides to be mindful of when deciding.

Photo: Investopedia

What do I need to apply for a BNPL?

Depending on the provider, BNPLs typically require a legal first and last name, email address, mobile number, and date of birth. Additionally, you must:

Before agreeing to any loan, check the loan documents provided by the company to understand any fees, charges or costs for which you may be responsible.

More information on our providers' websites:

Decided and ready to make a purchase?

https://www.centralcomputer.com/media/wysiwyg/BNPL.png

Please complete your information below to login.

Sign In

Create New Account